2024 AI in Investment Banking Survey

Oct 24, 2024

Insights from over 50 investment banking firms, uncovering how they are thinking about the use of AI in their operations today

As part of our ongoing work here at Farsight AI to automate complex and nuanced financial services workflows with proprietary generative AI technology, we’ve conducted a comprehensive AI in Investment Banking Market Survey. The survey focuses on the current opportunities, risks and adoption curve of AI within the industry. All respondents were pre-qualified to have significant input around any AI-related decisions that might be made at their firms.

In this summary, we will dive into the overarching themes related to the market (including burgeoning adoption within the middle-market and boutiques), specific findings with an emphasis on common use cases and features, and some general recommendations for investment banks looking to up-level their AI strategies. Common use cases today span idea generation, deal sourcing and deal execution, though security and quality remain top-of-mind concerns.

The integration of AI to investment banking promises to shift the market landscape, substantially boost efficiency, and unlock new opportunities for growth. However, common drawbacks including lack of customization to templates, sparse data coverage on small, private companies and uncertainty around use cases are currently clouding adoption trends. Our survey dives into the state of AI adoption in investment banking today, drawing on insights from a survey conducted with over 50 industry professionals. Through these survey calls, we synthesized bankers’ thoughts, expectations and cautions around the technology today, as well as how they anticipate these changing over time.

Overarching Themes — General State of the Market

Our overall takeaways related to the general adoption of AI in investment banking today are covered below. Clear-cut business functions and value propositions have already emerged from the relatively strong adoption curve of the technology today — especially within the middle-market and boutique investment banking communities.

Faster than Expected Adoption Curve

Takeaway: over 2/3 of Investment Banks have at least formally experimented with AI in some fashion to-date

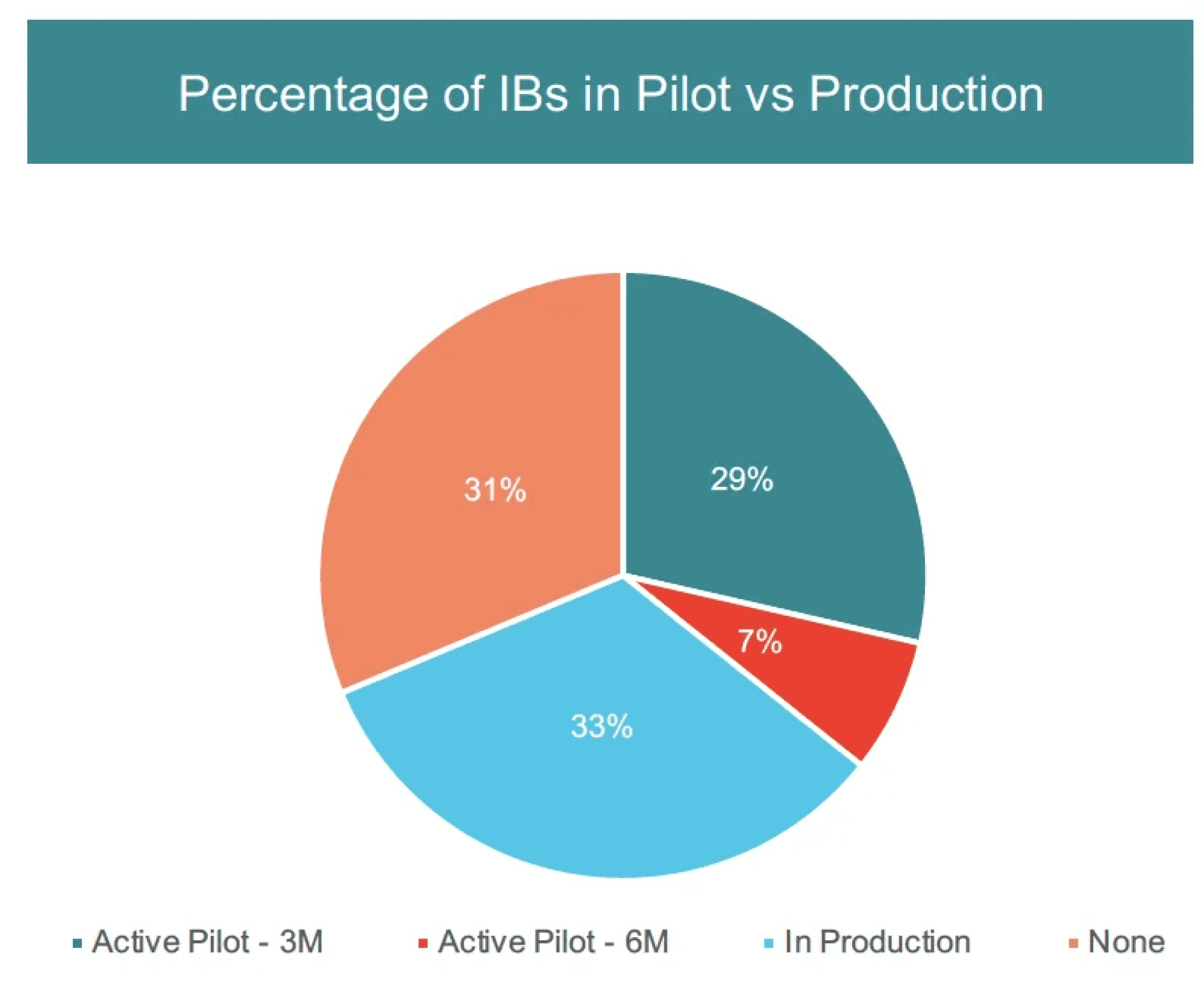

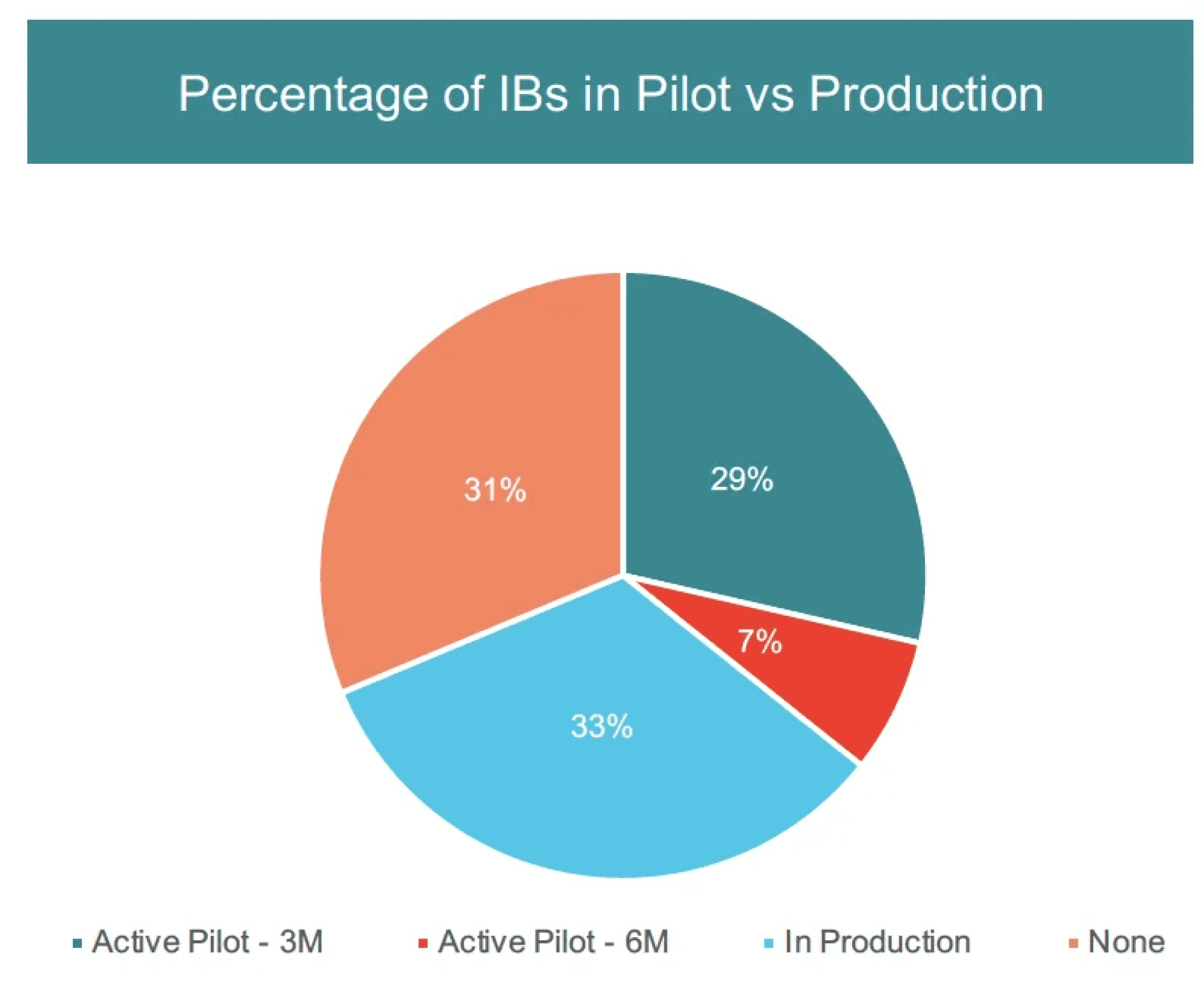

While investment banks traditionally can be somewhat behind-the-curve in tech adoption, the sector generally seems to have a high willingness to experiment with generative AI technologies. 36% engaged with a pilot of some sort this year, and one-third of all investment banks have at least one AI use case in production already. Note: specific ChatGPT workflows count as pilot / production if sanctioned at the firm-level

Usage (both pilots and production) spanning ChatGPT and other tools is pervasive throughout the market. Pilot — 3M signifies a 3-month long pilot, and Pilot — 6M reflects a 6-month long pilot. More detail on specific use cases in the detailed findings section.

Boutiques and Middle-Market IBs Forge the Path Ahead

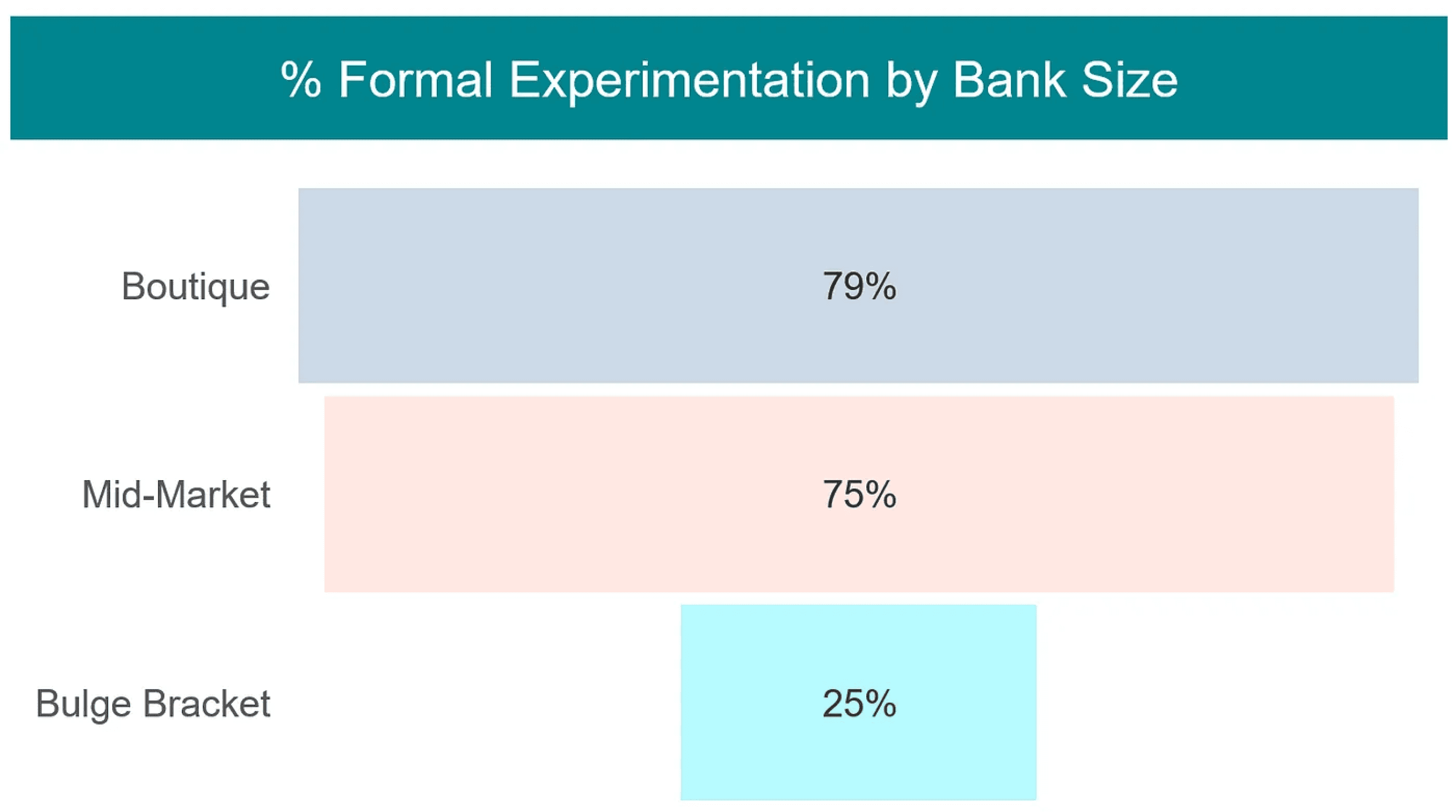

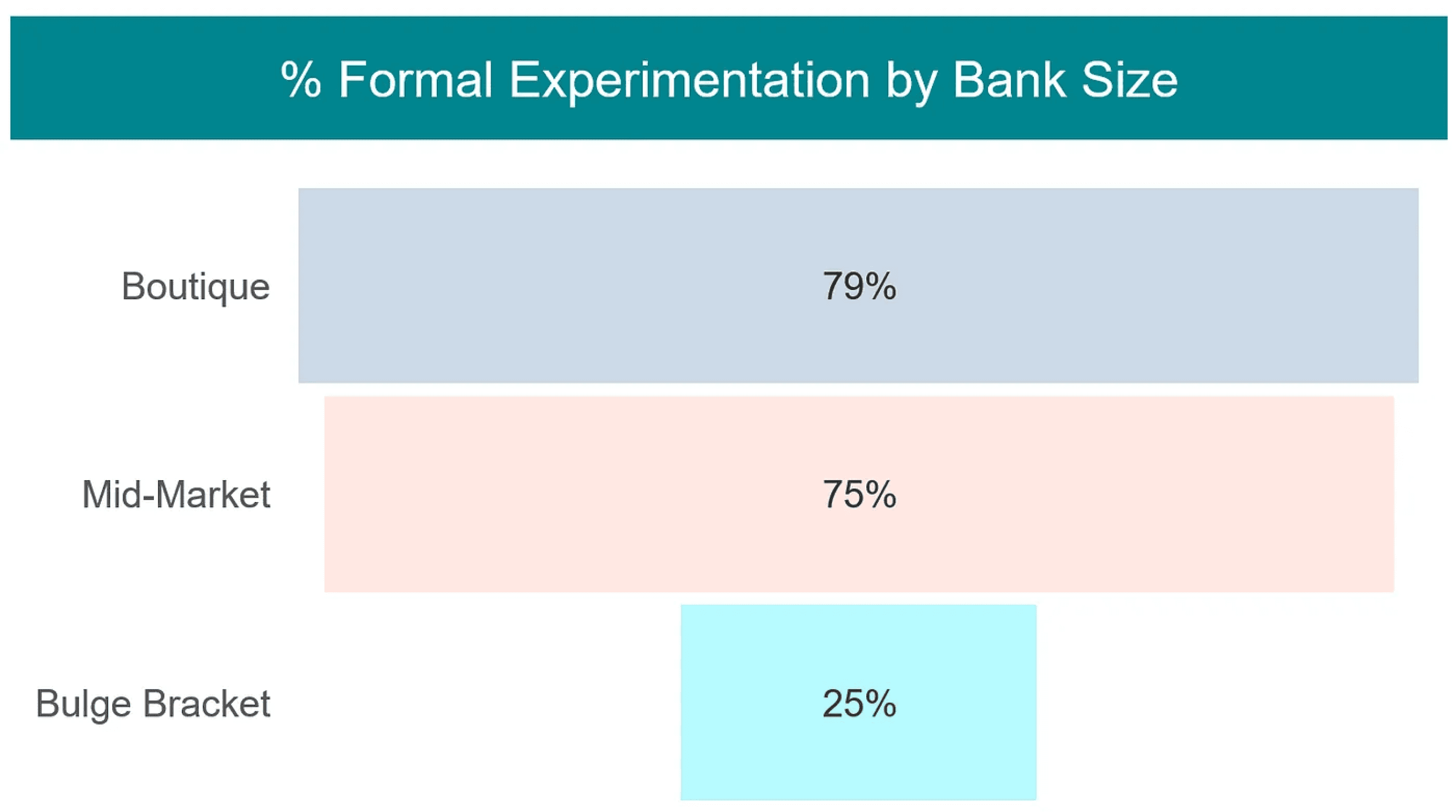

Takeaway: Adoption and value have been driven primarily within the boutique and mid-market investment banks (those with less than 500 employees)

While larger banks are experimenting with genAI, few apps and use cases are being used consistently in production at that scale. At the mid-market and boutique levels, the encouragement of in-house experimentation, combined with the willingness to work with third-party vendors, has accelerated the time-to-value of genAI apps.

It is worth noting that the value perceived by Bulge Brackets from successful implementations was significantly higher on a per-employee basis than their mid-market and boutique peers. This is primarily due to the volume of content creation as well as the sheer scale of work undertaken at these organizations. Thus, there remains a large opportunity, but many Bulge Brackets are still working through security, rollout, technology education and change management concerns.

Formal experimentation is defined as either an active pilot, firm-wide accepted genAI use case or firm licenses to popular tools (ChatGPT etc.)

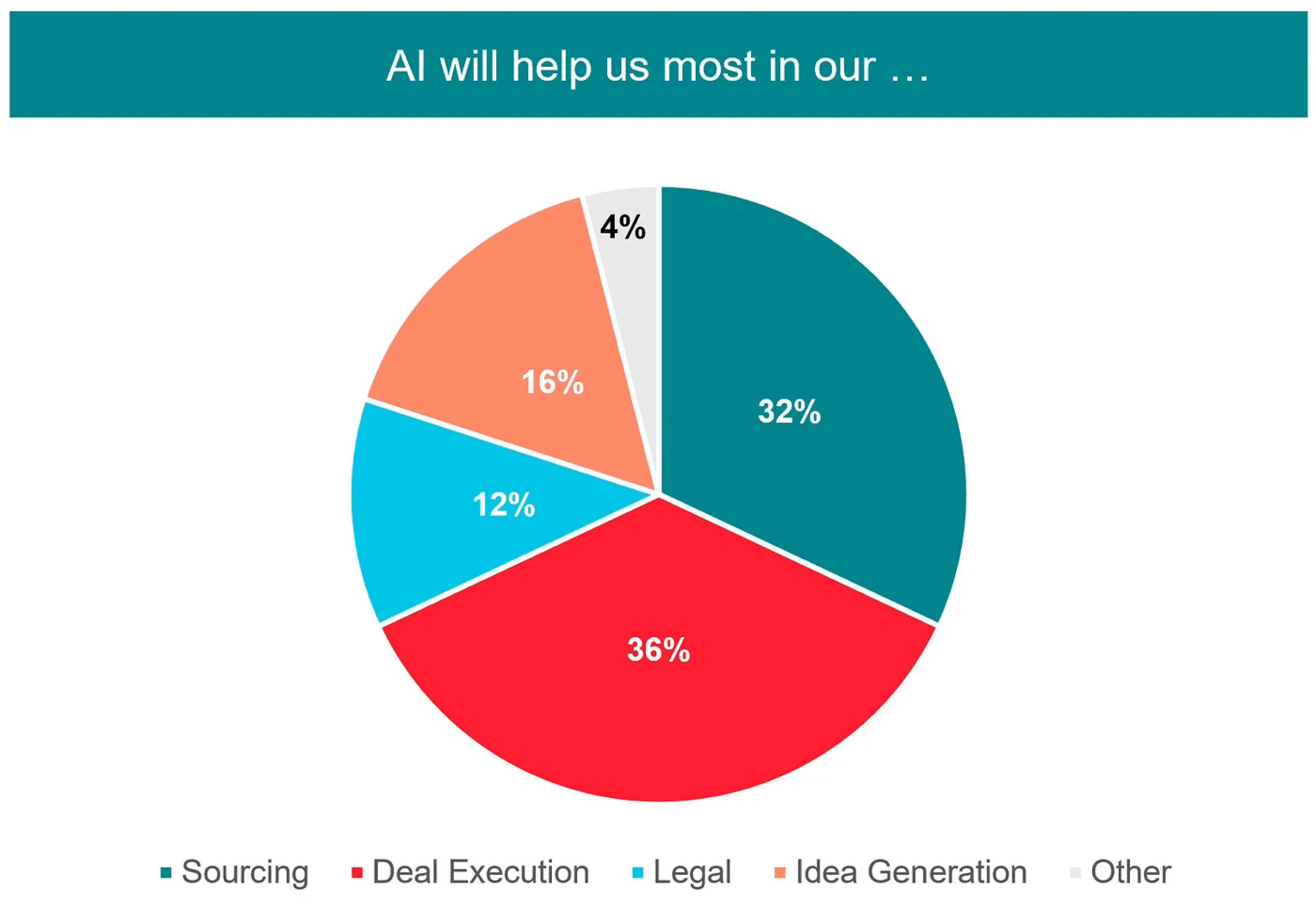

Perceived Value by Business Function Evenly Spread Out

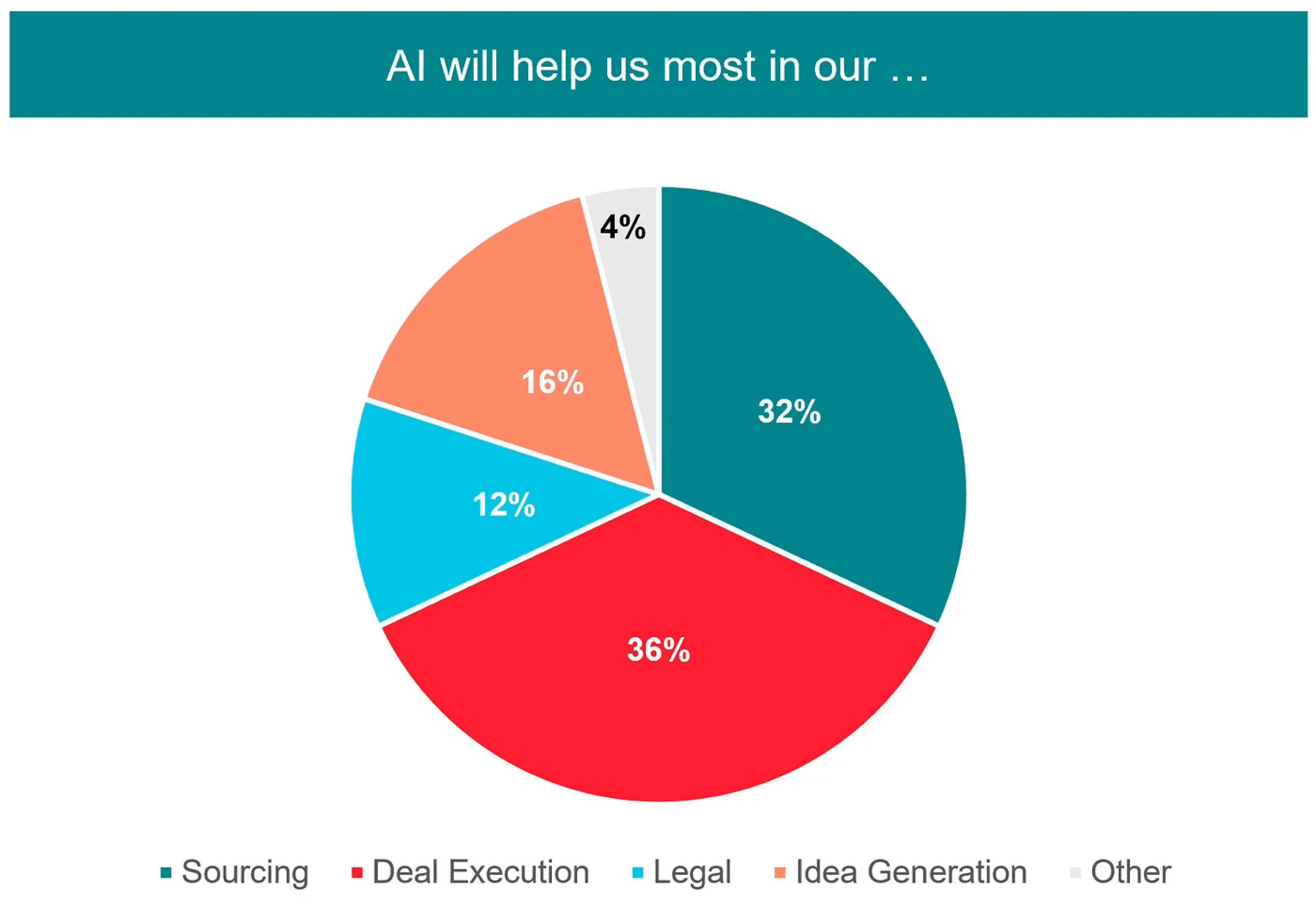

Takeaway: Sourcing, legal, execution / materials generation, and idea generation were all common, attractive areas where AI-powered workflows were being explored

Current trajectory and deal volume of the investment bank seemed to play a large role in the business function where the use of AI was most promising. The framing of this question was open-ended, with respondents able to articulate any business function that came to mind. Even so, nearly all respondents answered with one of the four categories listed above.

Sourcing and Deal Execution were the main business functions where people anticipated AI helping drive operational efficiency and performance most

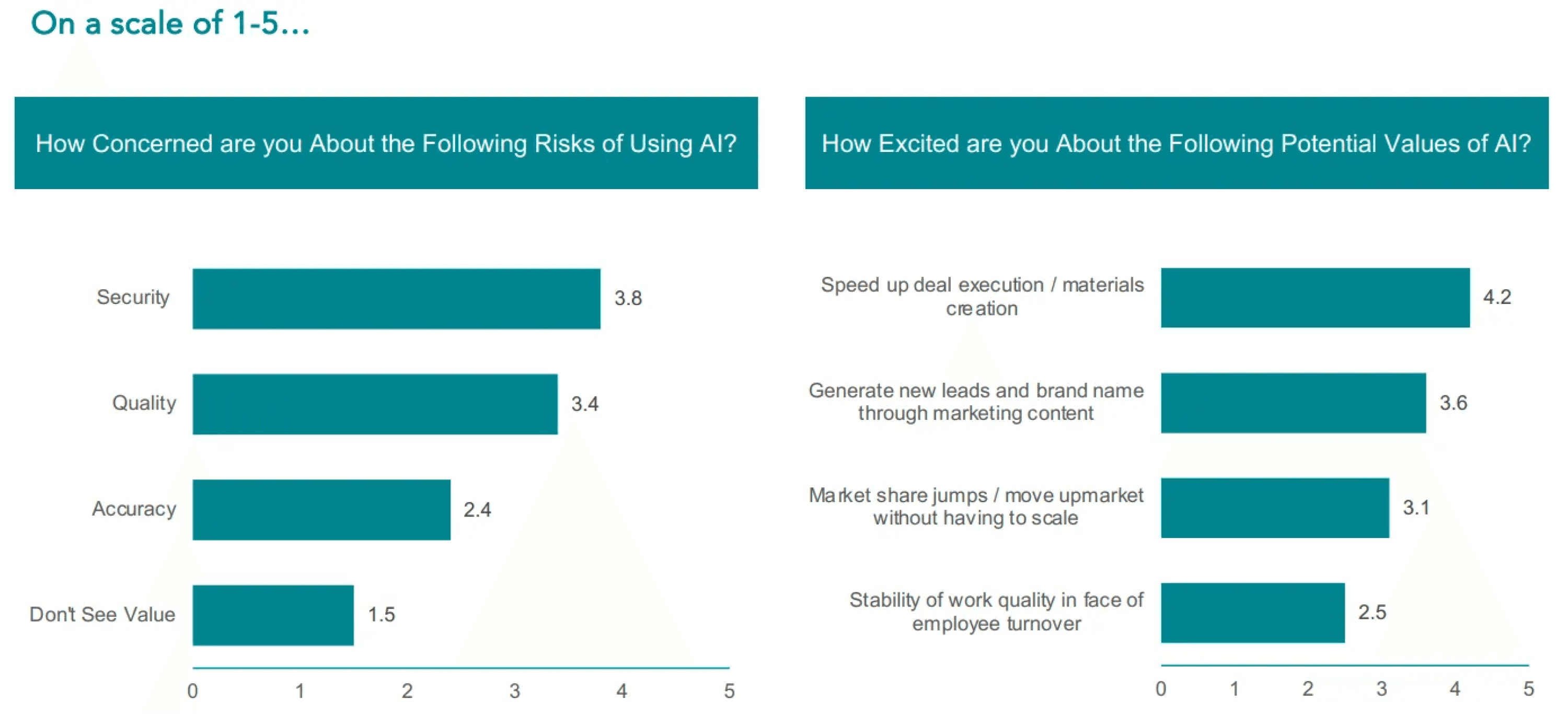

4. Perceived Benefits and Risks of AI

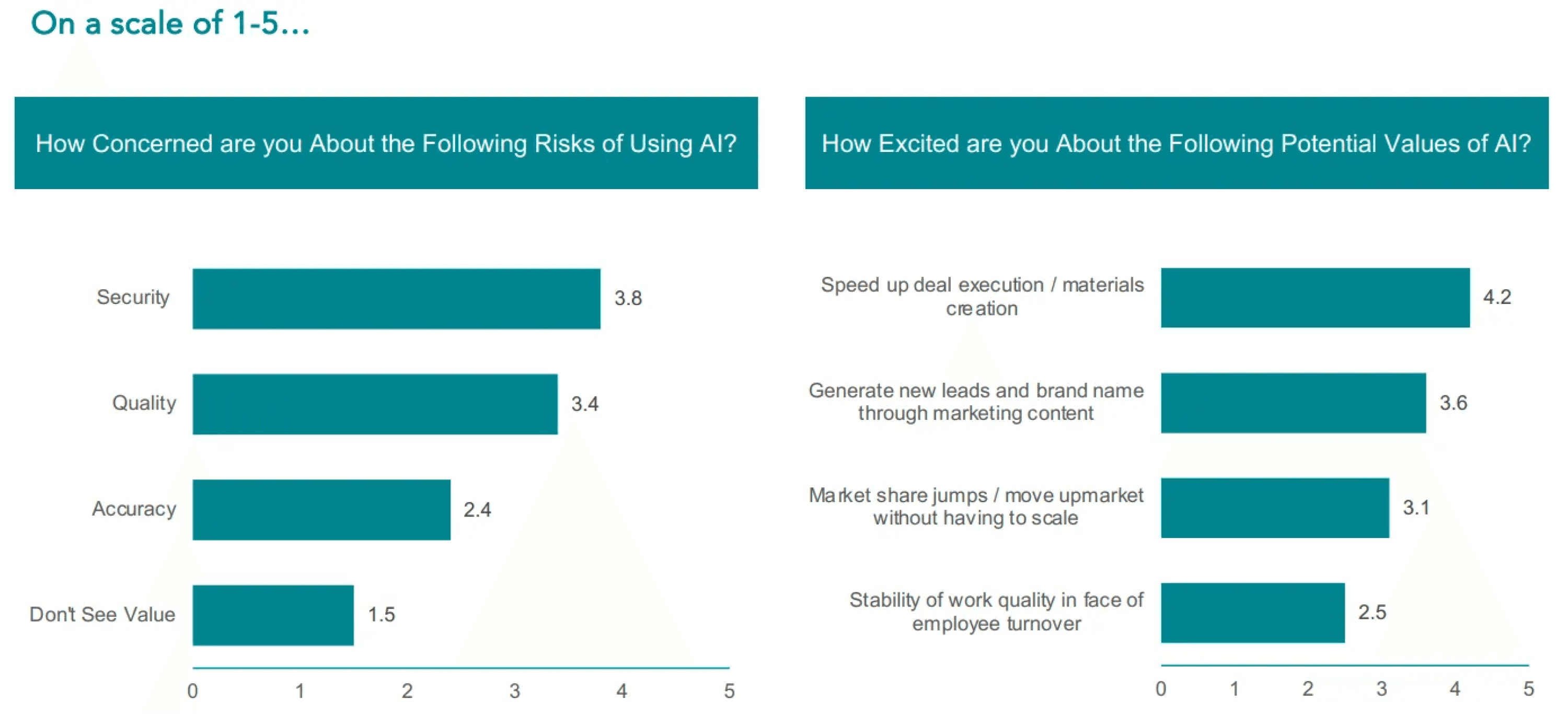

Participants underscored the importance of security and quality as tantamount to success in these initiatives. Firms are excited first and foremost by the efficiencies AI can help drive in deal processes, leading to superior client outcomes and faster time-to-close. They are also bullish on the prospect of getting in front of prospective sellers and buyers more efficiently, and leveraging the technology to get an edge on their competitors in this regard. Note that in the below graphic, quality relates to the overall work product as a result of leveraging AI, whereas accuracy relates purely to incorrect information or erroneous numbers (e.g. hallucinations).

Common Perceived Risks and Value Propositions of AI, rated on a scale of 1–5

Detailed Findings — AI in Action

This section distills findings related to the specific tools, use cases, value propositions and more related to AI in action within this industry today.

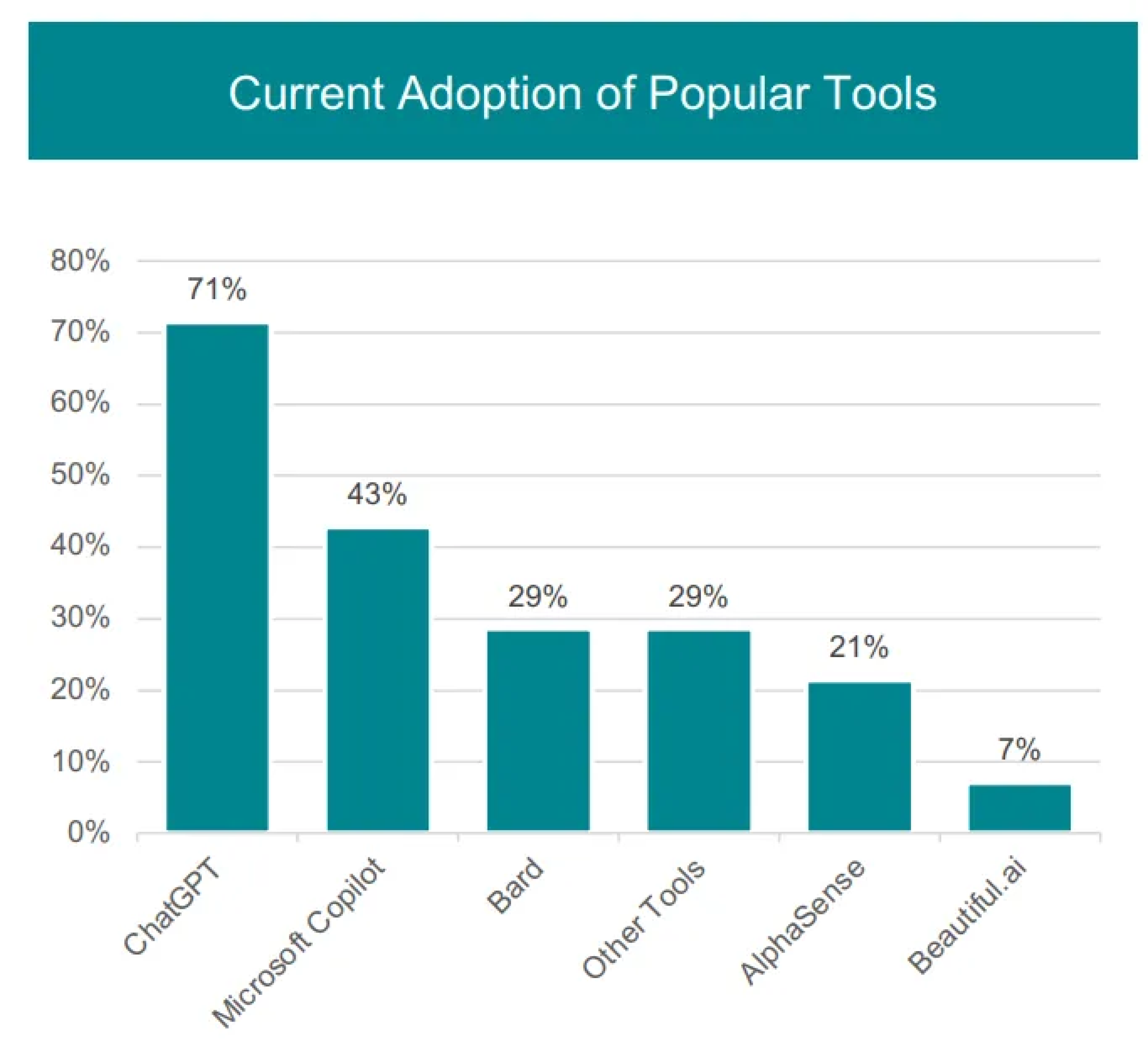

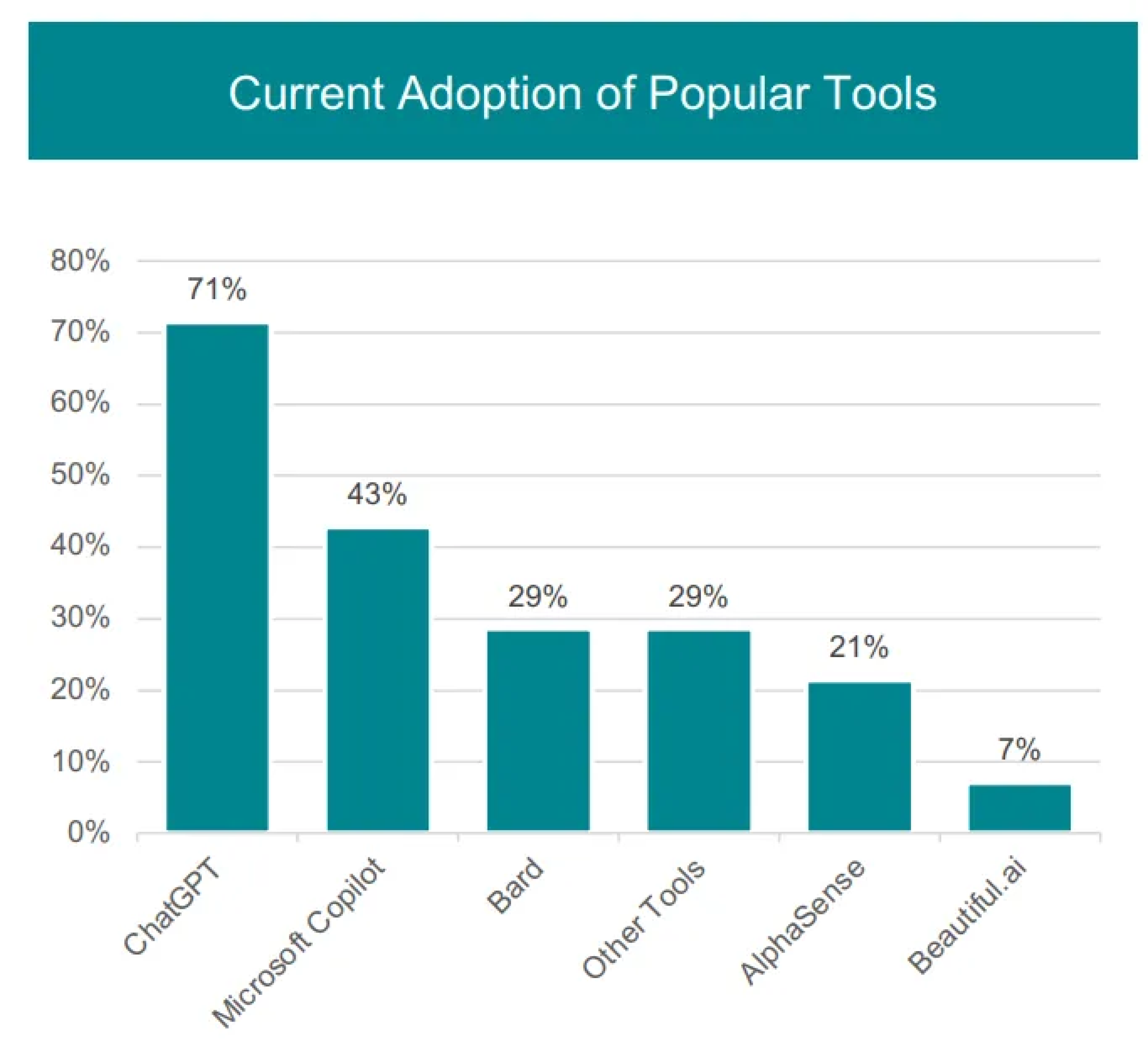

Awareness and Current Adoption of GenAI: Every single respondent had thought about the implications of AI, and every firm has had at least one internal conversation regarding the technology. Further, ~70% had some active pilot program or subscription already underway (including Microsoft CoPilot or firm-level ChatGPT licenses). The most widely-used tools were models or offerings from big technology companies, though as might be expected, these solutions struggled to go deep in driving leverage and high-quality content for nuanced investment banking workflows.

“Holy Grail” Use Cases: For the purpose of this specific question, we asked participants to suspend disbelief, and solely answer what they are most excited at AI potentially being able to help them with. Unsurprisingly, most popular use cases varied based on the scale of the bank.

Select “Holy Grail” use cases as mentioned on survey calls

Must-Have Features: We asked each respondent for features they thought would be critically important to apply the initial usefulness of horizontal tools like ChatGPT and Claude to their specific businesses. The most common responses, in order, were:

Fit to Existing Firm Templates

Auditability / AI “Shows its Work”

Integrations with Current CRM System

Integrations with Current Data Providers

Fit to Existing Workflows (Don’t Introduce a Separate Tool for my Employees to Use)

Support my Proprietary Knowledge in a Secure Manner

Survey Takeaway: A recent study by Deloitte highlights that AI can potentially generate up to $1 million annually in value uplift per employee within investment banking teams. Our survey corroborates this potential, with participants recognizing efficiency gains, superior outcomes, enhanced accuracy, and cost savings as key benefits. However, in order to realize these benefits, firms must overcome common issues such as data privacy, accuracy and ethical considerations. These mirror common concerns found in other sectors undergoing AI transformations (coding, customer support etc).

Selected Quotes

In addition to the summary findings above, we provide a subset of selected quotes from various participants to provide more color on results of the survey.

On AI Awareness: “AI is the buzzword everyone is talking about, but few truly understand its full potential in our field.” — VP, Houlihan Lokey

On Big Tech AI Offerings: “I’m AI-aware, but we haven’t made any real purchases. Microsoft has those in-built tools, but they don’t really take you that far in our job function” — Partner, Edgepoint Capital

On Security Concerns: “We hit the brakes quickly once we saw our junior staff using ChatGPT and Perplexity. There’s a huge potential data issue here, if people can see what we’re searching.” — VP, Dyal & Co

On Potential Market Share Impacts: “AI today allows us to take on more deals that would typically be outside our strike zone. We can get up to speed much more quickly, and generate the necessary content much faster with less.” — MD, Raymond James

On AI’s Impact: “There will be a real competitive advantage for those firms that are able to marry their proprietary knowledge with AI systems that can help across prospect generation, deal execution and content creation in a unique way for each specific firm.” — Partner, Union Square Advisors

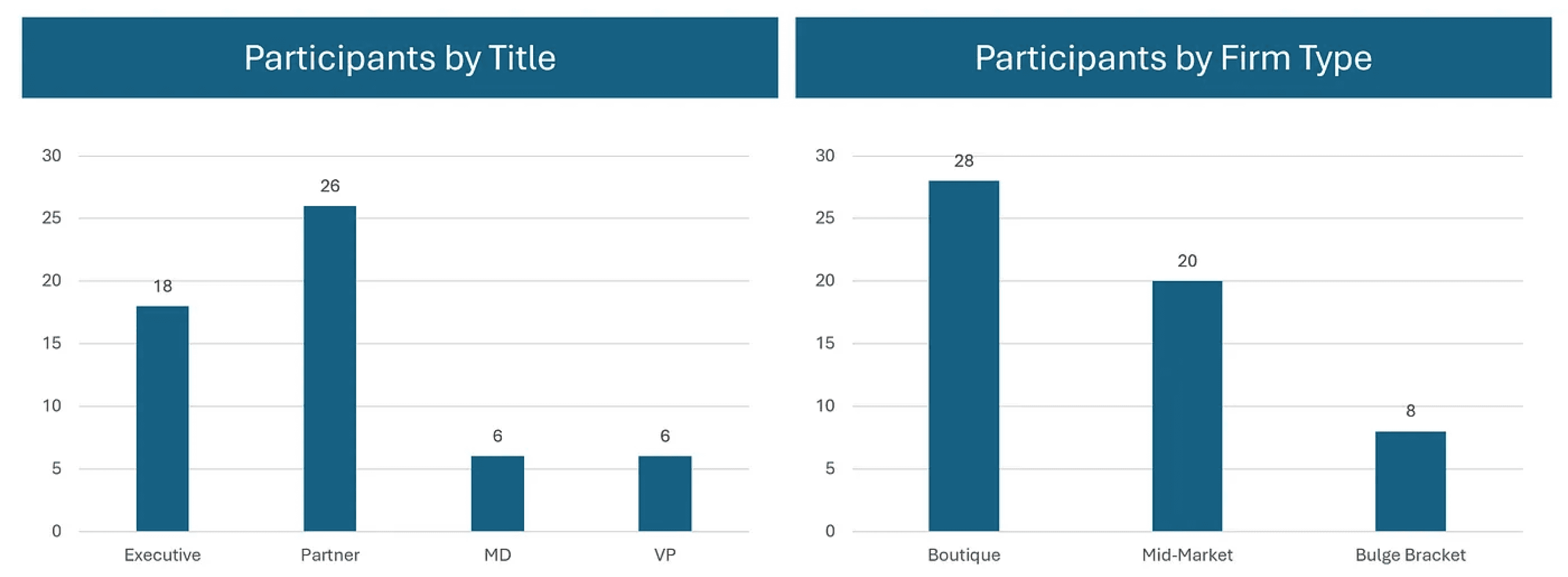

Survey Methodology

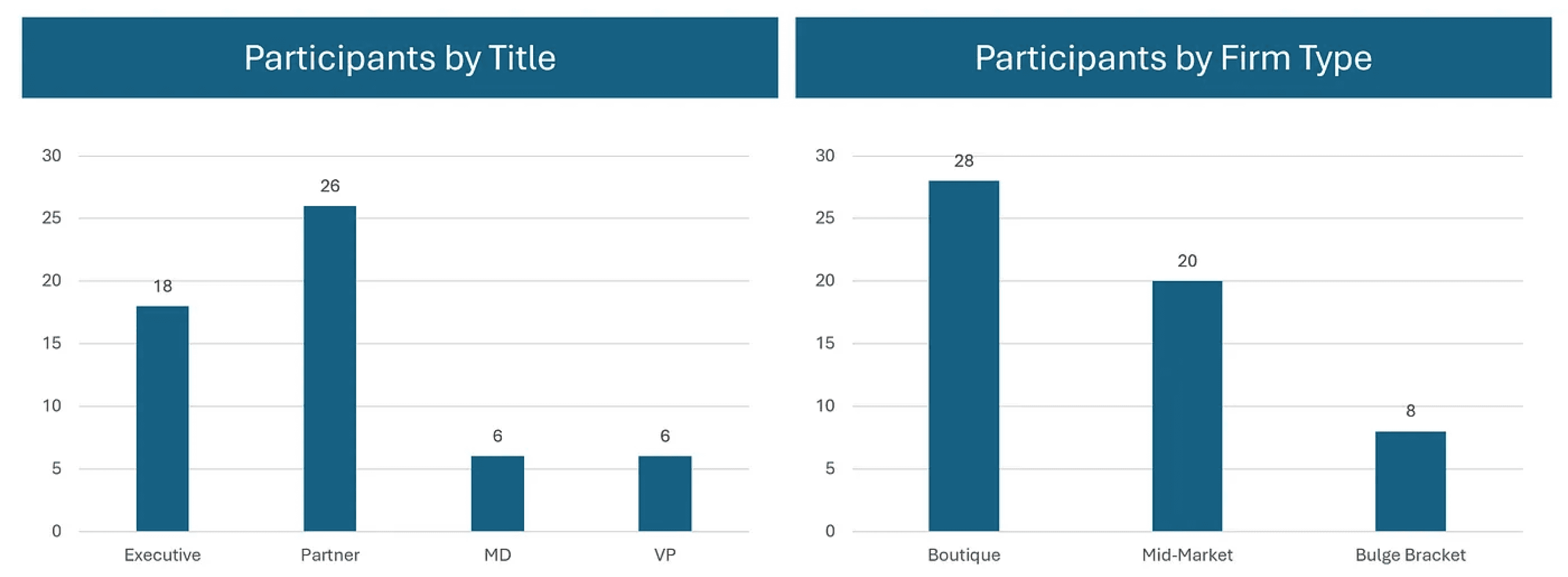

Our survey comprised of investment banking professionals from 50 different firms, encompassing mostly senior-level roles including executives, partners, MDs and VPs. Participants were selected to ensure a diverse representation in terms of industry coverage, geographic location, and areas of product specialization (i.e. M&A vs ECM). The survey consisted of a mix of multiple-choice and open-ended questions, and was designed to capture both quantitative data and qualitative insights. Data collection was conducted primarily via 30-minute calls. Below is a high-level overview of survey participants:

All banks interviewed were headquartered in the U.S. Survey participants were pre-vetted to have decision-making power as it relates to AI solutions.

Learnings and Conclusion

Based on the survey results, which clearly communicate the wide-ranging impact AI is expected to have on the investment banking industry, the following are potential actions firms can take to best equip themselves for the future:

Invest in Training and Development: Establish comprehensive training programs to enhance AI literacy among employees. Encourage continuous learning to keep pace with technological advancements.

Prioritize Data Security: Implement robust data security measures to protect sensitive information. Regularly review and update security protocols to mitigate risks associated with AI deployment.

Crawl, Walk, Run: Begin with pilot projects to test AI applications in specific areas. Use the insights gained to refine strategies and scale successful initiatives across the organization.

Selection Criteria: Common selection criteria to consider for starter projects / workflows are whether or not confidential information is required, frequency of usage and tolerance for errors.

Leverage Partnerships: Partner with technology firms, startups, and academic institutions to access cutting-edge AI technologies and expertise. Collaborations can accelerate AI adoption and innovations.

Matching Workflows: Chatbots will only get you so far within investment banking. Solutions that natively fit into existing workflows, make for the most seamless integration of AI, while delivering maximal leverage for business operations and revenue.

Firm Customizability: Leverage in-house teams, tech partners or consultants to fit your firm’s templates, and minimize friction experienced by bankers in adapting the new technology.

The disparity and variance in understanding of AI among IB professionals highlights the need for targeted education and training programs. Investment banks can benefit from initiatives that enhance AI literacy across all levels of the organization, ensuring all staff can effectively contribute to and benefit from AI projects, initiatives and use case ideation.

This survey of 50 investment banking professionals provides valuable insights into the current state and future prospects of AI adoption in the sector. While AI is already making significant inroads, there are challenges to address and opportunities to seize. By investing in training, fostering collaboration, and prioritizing the right partnerships, investment banks can harness the full potential of AI to drive innovation, efficiency, and a competitive advantage.

For any questions, additional information, or to learn more about Farsight AI, please feel free to contact us or email me directly at samir@farsight-ai.com

This article can also be found on Medium.

2024 AI in Investment Banking Survey

Oct 24, 2024

Insights from over 50 investment banking firms, uncovering how they are thinking about the use of AI in their operations today

As part of our ongoing work here at Farsight AI to automate complex and nuanced financial services workflows with proprietary generative AI technology, we’ve conducted a comprehensive AI in Investment Banking Market Survey. The survey focuses on the current opportunities, risks and adoption curve of AI within the industry. All respondents were pre-qualified to have significant input around any AI-related decisions that might be made at their firms.

In this summary, we will dive into the overarching themes related to the market (including burgeoning adoption within the middle-market and boutiques), specific findings with an emphasis on common use cases and features, and some general recommendations for investment banks looking to up-level their AI strategies. Common use cases today span idea generation, deal sourcing and deal execution, though security and quality remain top-of-mind concerns.

The integration of AI to investment banking promises to shift the market landscape, substantially boost efficiency, and unlock new opportunities for growth. However, common drawbacks including lack of customization to templates, sparse data coverage on small, private companies and uncertainty around use cases are currently clouding adoption trends. Our survey dives into the state of AI adoption in investment banking today, drawing on insights from a survey conducted with over 50 industry professionals. Through these survey calls, we synthesized bankers’ thoughts, expectations and cautions around the technology today, as well as how they anticipate these changing over time.

Overarching Themes — General State of the Market

Our overall takeaways related to the general adoption of AI in investment banking today are covered below. Clear-cut business functions and value propositions have already emerged from the relatively strong adoption curve of the technology today — especially within the middle-market and boutique investment banking communities.

Faster than Expected Adoption Curve

Takeaway: over 2/3 of Investment Banks have at least formally experimented with AI in some fashion to-date

While investment banks traditionally can be somewhat behind-the-curve in tech adoption, the sector generally seems to have a high willingness to experiment with generative AI technologies. 36% engaged with a pilot of some sort this year, and one-third of all investment banks have at least one AI use case in production already. Note: specific ChatGPT workflows count as pilot / production if sanctioned at the firm-level

Usage (both pilots and production) spanning ChatGPT and other tools is pervasive throughout the market. Pilot — 3M signifies a 3-month long pilot, and Pilot — 6M reflects a 6-month long pilot. More detail on specific use cases in the detailed findings section.

Boutiques and Middle-Market IBs Forge the Path Ahead

Takeaway: Adoption and value have been driven primarily within the boutique and mid-market investment banks (those with less than 500 employees)

While larger banks are experimenting with genAI, few apps and use cases are being used consistently in production at that scale. At the mid-market and boutique levels, the encouragement of in-house experimentation, combined with the willingness to work with third-party vendors, has accelerated the time-to-value of genAI apps.

It is worth noting that the value perceived by Bulge Brackets from successful implementations was significantly higher on a per-employee basis than their mid-market and boutique peers. This is primarily due to the volume of content creation as well as the sheer scale of work undertaken at these organizations. Thus, there remains a large opportunity, but many Bulge Brackets are still working through security, rollout, technology education and change management concerns.

Formal experimentation is defined as either an active pilot, firm-wide accepted genAI use case or firm licenses to popular tools (ChatGPT etc.)

Perceived Value by Business Function Evenly Spread Out

Takeaway: Sourcing, legal, execution / materials generation, and idea generation were all common, attractive areas where AI-powered workflows were being explored

Current trajectory and deal volume of the investment bank seemed to play a large role in the business function where the use of AI was most promising. The framing of this question was open-ended, with respondents able to articulate any business function that came to mind. Even so, nearly all respondents answered with one of the four categories listed above.

Sourcing and Deal Execution were the main business functions where people anticipated AI helping drive operational efficiency and performance most

4. Perceived Benefits and Risks of AI

Participants underscored the importance of security and quality as tantamount to success in these initiatives. Firms are excited first and foremost by the efficiencies AI can help drive in deal processes, leading to superior client outcomes and faster time-to-close. They are also bullish on the prospect of getting in front of prospective sellers and buyers more efficiently, and leveraging the technology to get an edge on their competitors in this regard. Note that in the below graphic, quality relates to the overall work product as a result of leveraging AI, whereas accuracy relates purely to incorrect information or erroneous numbers (e.g. hallucinations).

Common Perceived Risks and Value Propositions of AI, rated on a scale of 1–5

Detailed Findings — AI in Action

This section distills findings related to the specific tools, use cases, value propositions and more related to AI in action within this industry today.

Awareness and Current Adoption of GenAI: Every single respondent had thought about the implications of AI, and every firm has had at least one internal conversation regarding the technology. Further, ~70% had some active pilot program or subscription already underway (including Microsoft CoPilot or firm-level ChatGPT licenses). The most widely-used tools were models or offerings from big technology companies, though as might be expected, these solutions struggled to go deep in driving leverage and high-quality content for nuanced investment banking workflows.

“Holy Grail” Use Cases: For the purpose of this specific question, we asked participants to suspend disbelief, and solely answer what they are most excited at AI potentially being able to help them with. Unsurprisingly, most popular use cases varied based on the scale of the bank.

Select “Holy Grail” use cases as mentioned on survey calls

Must-Have Features: We asked each respondent for features they thought would be critically important to apply the initial usefulness of horizontal tools like ChatGPT and Claude to their specific businesses. The most common responses, in order, were:

Fit to Existing Firm Templates

Auditability / AI “Shows its Work”

Integrations with Current CRM System

Integrations with Current Data Providers

Fit to Existing Workflows (Don’t Introduce a Separate Tool for my Employees to Use)

Support my Proprietary Knowledge in a Secure Manner

Survey Takeaway: A recent study by Deloitte highlights that AI can potentially generate up to $1 million annually in value uplift per employee within investment banking teams. Our survey corroborates this potential, with participants recognizing efficiency gains, superior outcomes, enhanced accuracy, and cost savings as key benefits. However, in order to realize these benefits, firms must overcome common issues such as data privacy, accuracy and ethical considerations. These mirror common concerns found in other sectors undergoing AI transformations (coding, customer support etc).

Selected Quotes

In addition to the summary findings above, we provide a subset of selected quotes from various participants to provide more color on results of the survey.

On AI Awareness: “AI is the buzzword everyone is talking about, but few truly understand its full potential in our field.” — VP, Houlihan Lokey

On Big Tech AI Offerings: “I’m AI-aware, but we haven’t made any real purchases. Microsoft has those in-built tools, but they don’t really take you that far in our job function” — Partner, Edgepoint Capital

On Security Concerns: “We hit the brakes quickly once we saw our junior staff using ChatGPT and Perplexity. There’s a huge potential data issue here, if people can see what we’re searching.” — VP, Dyal & Co

On Potential Market Share Impacts: “AI today allows us to take on more deals that would typically be outside our strike zone. We can get up to speed much more quickly, and generate the necessary content much faster with less.” — MD, Raymond James

On AI’s Impact: “There will be a real competitive advantage for those firms that are able to marry their proprietary knowledge with AI systems that can help across prospect generation, deal execution and content creation in a unique way for each specific firm.” — Partner, Union Square Advisors

Survey Methodology

Our survey comprised of investment banking professionals from 50 different firms, encompassing mostly senior-level roles including executives, partners, MDs and VPs. Participants were selected to ensure a diverse representation in terms of industry coverage, geographic location, and areas of product specialization (i.e. M&A vs ECM). The survey consisted of a mix of multiple-choice and open-ended questions, and was designed to capture both quantitative data and qualitative insights. Data collection was conducted primarily via 30-minute calls. Below is a high-level overview of survey participants:

All banks interviewed were headquartered in the U.S. Survey participants were pre-vetted to have decision-making power as it relates to AI solutions.

Learnings and Conclusion

Based on the survey results, which clearly communicate the wide-ranging impact AI is expected to have on the investment banking industry, the following are potential actions firms can take to best equip themselves for the future:

Invest in Training and Development: Establish comprehensive training programs to enhance AI literacy among employees. Encourage continuous learning to keep pace with technological advancements.

Prioritize Data Security: Implement robust data security measures to protect sensitive information. Regularly review and update security protocols to mitigate risks associated with AI deployment.

Crawl, Walk, Run: Begin with pilot projects to test AI applications in specific areas. Use the insights gained to refine strategies and scale successful initiatives across the organization.

Selection Criteria: Common selection criteria to consider for starter projects / workflows are whether or not confidential information is required, frequency of usage and tolerance for errors.

Leverage Partnerships: Partner with technology firms, startups, and academic institutions to access cutting-edge AI technologies and expertise. Collaborations can accelerate AI adoption and innovations.

Matching Workflows: Chatbots will only get you so far within investment banking. Solutions that natively fit into existing workflows, make for the most seamless integration of AI, while delivering maximal leverage for business operations and revenue.

Firm Customizability: Leverage in-house teams, tech partners or consultants to fit your firm’s templates, and minimize friction experienced by bankers in adapting the new technology.

The disparity and variance in understanding of AI among IB professionals highlights the need for targeted education and training programs. Investment banks can benefit from initiatives that enhance AI literacy across all levels of the organization, ensuring all staff can effectively contribute to and benefit from AI projects, initiatives and use case ideation.

This survey of 50 investment banking professionals provides valuable insights into the current state and future prospects of AI adoption in the sector. While AI is already making significant inroads, there are challenges to address and opportunities to seize. By investing in training, fostering collaboration, and prioritizing the right partnerships, investment banks can harness the full potential of AI to drive innovation, efficiency, and a competitive advantage.

For any questions, additional information, or to learn more about Farsight AI, please feel free to contact us or email me directly at samir@farsight-ai.com

This article can also be found on Medium.

© 2024 Farsight AI, Inc.

All rights reserved.

Corporate HQ:

One Kendall Square, Suite B2102, Cambridge, MA 02139

NY Office:

2 Park Ave (Floor 20), New York, NY 10016

© 2024 Farsight AI, Inc.

All rights reserved.

Corporate HQ:

One Kendall Square, Suite B2102, Cambridge, MA 02139

NY Office:

2 Park Ave (Floor 20), New York, NY 10016

© 2024 Farsight AI, Inc.

All rights reserved.

Corporate HQ:

One Kendall Square, Suite B2102, Cambridge, MA 02139

NY Office:

2 Park Ave (Floor 20), New York, NY 10016